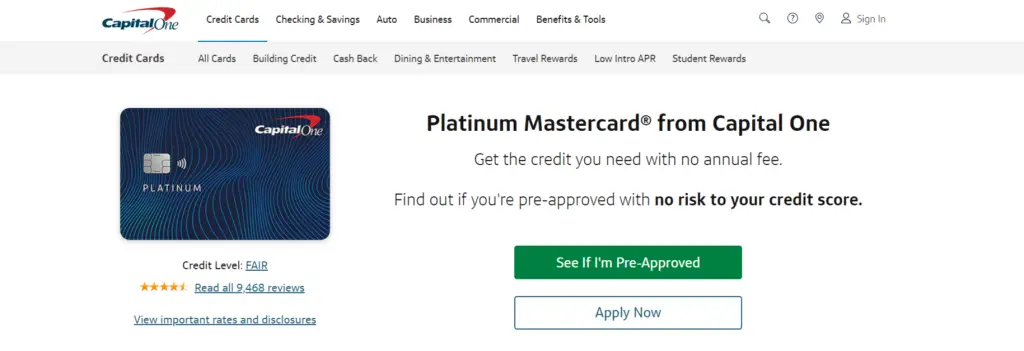

Have you come across the Capital One Platinum Credit Card? The Capital One Platinum aims to help users build credit over time as they make on-time payments, with no annual fee required. In this post, we will be reviewing

Overview of Capital One Platinum Credit Card

The Capital One Platinum Credit Card is designed for people looking to build credit. It doesn’t offer rewards, making it ideal for those who want to avoid the temptation of overspending. The card is available to those with fair credit, and Capital One reviews accounts after six months for a possible credit limit increase.

However, it has a high variable APR of 29.99%, so it’s best for those who can pay their balance in full each month while building their credit.

Good Side about Capital One Platinum

The Capital One Platinum Credit Card offers a few valuable benefits, especially for those building credit:

- Automatic credit line reviews after six months for a potential increase.

- CreditWise access for monitoring your credit score.

- Customizable account alerts to keep track of purchases and payment due dates.

- Emergency card replacement service if your card is lost or stolen.

- Virtual card numbers from ENO to protect your details when shopping online.

What We Like about Capital One Platinum Card

- No rewards: Unlike other credit-building cards, it doesn’t offer any rewards.

- High APR: With a regular APR of 29.99%, it’s higher than the national average.

- No introductory APR offers: There’s no initial APR offer to help save on interest if you carry a balance.

- Steep late payment fee: A high late payment fee of up to $40, above the typical $32 fee.

Is the Capital One Platinum Worth It?

The Capital One Platinum can be a good choice for those looking to build credit and work toward a higher credit limit without the distraction of rewards. However, its high APR makes it less ideal for carrying a balance, so it’s best for those who plan to pay off their balance in full each month. Before deciding, it’s wise to compare it with other credit cards for fair credit to ensure you’re making the best choice.

Are There Alternative to the Capital One Platinum Credit Card?

If you’re looking to build credit, consider other credit cards that offer rewards, such as cash back or points, especially if you have no credit, limited credit history, or a fair credit score.

Additionally, because the Capital One Platinum has a high APR, it’s best suited for those who plan to pay off their balance in full each month. If you might carry a balance, look for credit cards with a lower APR.

Can We Qualify for the Capital One Platinum with Bad Credit?

To qualify for the Capital One Platinum credit card, a credit score of at least 580 is recommended. If your score is lower, you may need to consider credit cards specifically designed for bad or no credit.

Read more:

Frownies for Wrinkle Patches

Gopure Neck Cream

RivalTAC Mosquito Repeller

Buzzhawk AI