Falling victim to a Venmo scam can be overwhelming, but don’t worry—this guide will walk you through the essential steps to recover your money, report the fraud, and safeguard yourself from future scams.

What Is Venmo Scam?

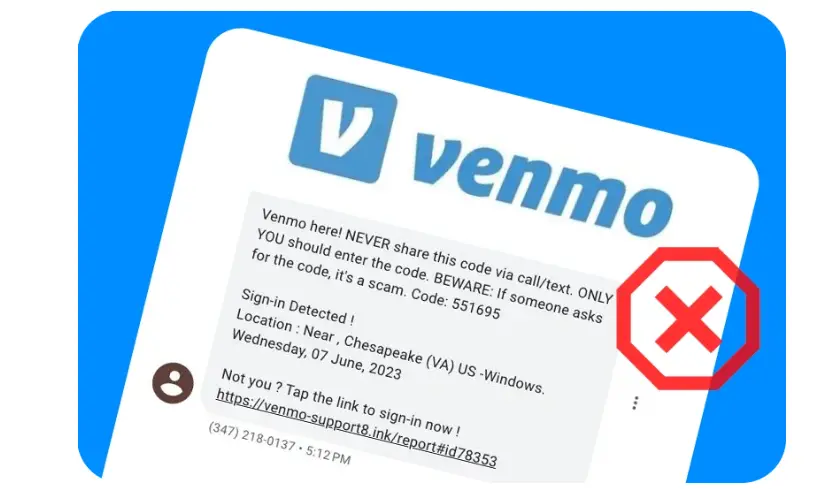

Venmo scams involve fraudulent activities where scammers deceive users into sending money or sharing personal information. Common tactics include impersonation, phishing, fake sales, and job scams. Scammers exploit emotions like fear and urgency to trick victims into quick decisions.

Since Venmo transactions are instant and irreversible, falling for a scam can lead to significant financial loss, making caution essential when using the platform.

How Does Venmo Scam Work?

Scammers excel at exploiting emotions by creating a false sense of urgency or security. They might hack into a friend’s Venmo account and urgently request money, making it seem like a real emergency.

Alternatively, they send a convincing email with the Venmo logo, prompting you to click a link and enter your login details on a fake website.

These tactics are designed to trick you into acting quickly without verifying the situation.

Identifying Venmo Scam

Unexpected Money Requests: Be wary of sudden requests for money, especially if they create urgency or come from someone you don’t know well. Always confirm the identity of the person making the request, even if it appears to be from a friend.

Unbelievable Offers: If an offer seems too good to be true, whether it’s a job, sale, or prize, take the time to verify its authenticity before sending any money.

Requests for Sensitive Information: Legitimate companies will never ask for your password, Social Security number, or bank details via email or text. Always confirm such requests through official channels, like contacting customer service directly.

Do This To Protect Yourself from Venmo Scam

Keep Records: Take screenshots of the transaction, any messages exchanged with the scammer, and their profile details. These records are crucial when reporting the scam to Venmo, your bank, or law enforcement.

Update Your Password: If you think your account has been compromised, immediately change your Venmo password. Make sure the new password is strong and unique, using a mix of letters, numbers, and special characters.

Activate Two-Factor Authentication: Enable two-factor authentication (2FA) on Venmo, which requires a code sent to your phone whenever you log in from a new device. This adds an extra layer of protection to your account.

How To Report Venmo Scam?

Reach Out to Venmo Support: Report the scam directly to Venmo through their app or website:

- Open the Venmo app and go to the “Me” tab.

- Find and select the transaction you want to dispute under “Transactions.”

- Tap “Need Help?” and follow the instructions to report the issue. Reporting to Venmo is crucial not only for a chance at recovering your funds but also to prevent the scammer from targeting others.

Email Venmo: If you encounter a phishing attempt, forward the suspicious email to [email protected]. For scams via text, send screenshots to [email protected]. This helps Venmo track and stop phishing scams.

Notify Your Bank: If your bank account is linked to Venmo, inform your bank about the scam right away. They can check for unauthorized transactions and may help freeze your account to prevent further losses.

Report to Authorities: Consider reporting the scam to the Federal Trade Commission (FTC) and your local law enforcement. The FTC collects data on scams to help investigate and prevent further incidents.

Bottom Line:

Stay vigilant and prioritize your security when using digital payment platforms like Venmo. While recovering lost funds can be challenging, following these steps can protect your finances and help prevent others from falling victim to similar scams.

Read more: